Senior Citizen Health Insurance

Settled in Qatar. Insured in our care.

Residents in Qatar know that healthcare can be costly, with as much as 70% of healthcare services in the country provided by private centers. Whether for your routine care, unexpected medical needs, or emergencies, our affordable health insurance plans offer you basic medical coverage for a minimum premium.

Getting started with our Senior Citizen Health Insurance plan is a simple and straightforward process. Just answer a few questions, and we’ll tailor a quote that builds your healthcare journey around your unique lifestyle and life stage in Qatar.

- State of Qatar only

- Hospitalization

- Emergency Services

- Doctor visits/Consultation

- Ambulatory (Labs, X-Rays, MRI, etc.)

- Medication

- Emergency Ambulance Services

What medical care am I eligible for with Senior Citizen Health Insurance?

Your medical insurance covers:

- Cost of covered services needed to receive acute/emergency medical treatment

- Cost of covered services needed to assist you after receiving medical treatment. We describe these in the insured’s schedule of benefits.

Uncovered treatments are listed in the non-exhaustive exclusions table.

Where can I receive treatment?

We have agreements with selected medical providers which are listed within your insurance pack. You may elect to use any of them unless there is a specific reference to an exclusion in the table of benefits.

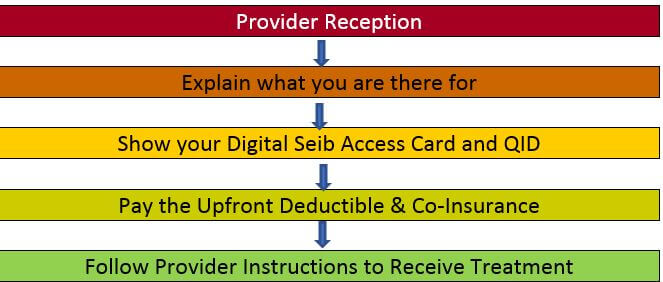

To receive treatment, simply show your digital card at a provider reception, pay any applicable deductible and the co-insurance, and proceed to receive eligible treatment.

Can I pay in cash and claim the amount from the insurance company?

Unfortunately, reimbursement is not covered under your medical scheme and thus we always advise you to visit one of our network providers in case any treatment is required.

Am I eligible for physiotherapy treatment?

Unfortunately, physiotherapy is not part of your QMed Residents medical insurance scheme.

How can I claim a covered benefit?

I have a chronic condition, how is chronic medication dispensed?

Kindly note that chronic and pre-existing medical conditions are not covered under your QMed Residents medical insurance scheme.

Pre-existing condition is an illness, injury, condition, or symptom that originated prior to the insured coverage date (policy enrolment date). This restriction applies to all insured in line with policy wording whether a diagnosed condition is known or unknown to the insured prior to the policy enrolment date; however considered as medically pre-existing (present/manifested in the body prior to the commencement of insurance cover).

I am confused with “pre-authorization” or “prior approval”. Isn’t this time consuming?

Look at the prior approval process in this way:

- Not every treatment requires approval

- Most out-patient services do not require prior approval

- Prior approval is required for hospital admission (as in-patient)

- Prior approval is required for radiology scans and is also linked to a certain cost schedule

- A medical provider may request prior approval if in doubt of the treatment under your insurance coverage

- In case you experience any delay, please be patient and contact us via our 24/7 helpline on +974 444 55 999

Our claims administrator replies to almost 97% of requests within 20 minutes which helps to:

- Reduce your waiting time at the providers

- Get you the necessary medical attention quicker

Does the same procedure apply in emergencies?

Your health is a priority. A medical condition that may lead to disability or loss of life will not wait for our approval. Please let us know a day or two after the admission. This helps us assist you much faster and reduces any future misunderstanding. Wherever you are in the world, Seib Insurance covers you for emergency treatment.

What is the general waiting time for a pre-approval?

The waiting time for an approval depends on the type of service requested. Generally speaking, the following timings apply:

- 2 – 5 minutes for automatic approvals. This is for consultations, medications and other straight forward treatment requests such as X-Rays, blood tests and eligible medicine dispensation

- 30 minutes for approval of minor out-patient day care cases and/or surgeries

- 1 working day for approval of in-patient cases.

Documents provided by the clinic/hospital need to be complete in order for the above timings to be met. If the file was submitted incomplete, this could lead to a delay and a breach of the above timings. We urge all insureds to call our 24/7 helpline number should they feel they are experiencing a delay at any time in order for the team to accelerate the process.

Is there any exclusion under my Senior Citizen Health Insurance?

Yes, examples of common exclusions are mentioned within your schedule of benefits. Please refer to your insurance policy wording for all applicable exclusions.

What is the period of insurance cover?

One year (365 days) from the date of policy issuance unless a different period of insurance was agreed with you specifically.

What is the premium amount? Are there additional charges included?

Premium and other charges, if any, are mentioned in the quotation enclosed with your premium document.

How and when can I pay the premium?

Premium is due with your application to arrange and activate the insurance policy. In respect of policy renewals, payment is required prior to the renewal/expiry date. The insurance premiums can be paid by debit card, credit card, bank transfer, online and cash up to QAR 1000 (One Thousand Qatari Riyals) paid at Seib Insurance office. Payment by cheque is accepted however policy activation is subject to realization of the cheque.

How can I cancel the contract?

If no claim was made on the insurance policy, we will refund 10% of the premium on a pro rata basis (i.e., based on the remaining number of days).

How can I file a complaint?

Should you have a complaint about deficiency in the services or the products offered, please contact our Compliance & AML Manager by phone on the following numbers: (+974) 4402 6807 or (+974) 4402 6888 or by mail to the following postal address: Seib Insurance and Reinsurance Company, P.O. Box 10973, Doha Qatar, or by email to complaints@seibinsurance.com, setting out clearly the exact details of your complaint.

We handle customer complaints fairly, efficiently and with due diligence as per the complaints procedure. If you remain dissatisfied with our response, you have the right to refer the complaint to the QFC Customer Dispute Resolution Scheme either by email to complaints@cdrs.org.qa or by post to “The Customer Dispute Resolution Scheme”, P.O. Box 22989, Doha Qatar.

For any further information, please contact:

Seib Insurance & Reinsurance Company

Sheikh Jabor Bin Yousef Bin Jassim Althani Building, Airport Street, PO Box Number: 10973, Doha – Qatar.

Tel: +974 4402 6888, Fax: +974 4402 6800, Email: info@seibinsurance.com