Group Medical Insurance

Collective care for your business health

In today’s competitive business environment and job market, the health of your team is as crucial as your bottom line. Our group medical insurance is designed with this philosophy at its core. Beyond individual coverage for a wide range of healthcare needs, our comprehensive employee medical insurance products help you create and nurture an environment that boosts your talent retention, morale, and productivity.

| Global | Medical insurance extending to worldwide |

| Continental | Medical insurance providing worldwide cover (excluding USA and Canada) |

| MEANA | Medical insurance extending to Middle East, North Africa, Indian subcontinent and Southeast Asia |

| Home | Medical insurance extending to state of Qatar |

- Hospitalization

- Emergency Services

- Doctor visits/Consultation

- Medication

- Ambulatory (Labs, X-Rays, MRI, etc.)

- Emergency Ambulance Services

- Global Emergency Services

- Repatriation of Mortal Remains

- Nursing at Home

- Organ Transplant

- Physiotherapy

- Dental

- Optical

Group Medical

What am I eligible for under this scheme?

Your medical insurance covers:

- Cost of medical treatment

- Cost of covered services needed to receive medical treatment

- Cost of covered services needed to assist you after receiving medical treatment. We describe these in the insured’s schedule of benefits

- Uncovered treatments are listed in the non-exhaustive exclusions table.

Where can I receive treatment?

We have agreements with selected medical providers that will be shared with you within your insurance pack. You may elect to use any of them unless there is a specific reference to an exclusion in the table of benefits.

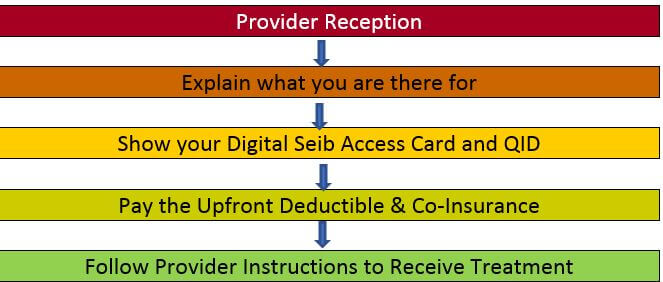

To receive treatment, you simply present your card at a provider reception, pay any applicable deductible and proceed to receive your treatment.

Insured members may also elect to receive treatment somewhere else. As long as your treating physician or treatment center is a licensed one, costs incurred can be submitted to us for reimbursement.

How can I claim a covered benefit?

At a non-network provider,

simply pay for the medical services you are about to receive and submit your claim for reimbursement. This can be done by keeping the following documents to be presented later to Seib Insurance:

At a non-network provider,

simply pay for the medical services you are about to receive and submit your claim for reimbursement. This can be done by keeping the following documents to be presented later to Seib Insurance:

- Original completed claim form or detailed medical report

- Copy of your Seib Insurance medical card

- Original itemized receipt

- Original prescription issued by your licensed physician

- Copy of tests, hospital discharge reports, doctor reports and results

- Copy of your prior approval if available

- Copy of a discharge summary in case of hospitalization

- 60 days from treatment date inside Qatar

- 90 days from treatment date outside Qatar

I have a chronic condition, how is chronic medication dispensed?

- Visit your consulting doctor

- Complete the application for chronic prescription medication and get it signed and stamped by the treating physician

- E-mail the completed form tocsr@seibinsurance.com

- In your email, please advise us from which pharmacy you would prefer to collect your medication

- A Seib Insurance customer service officer will process the approval within 1 working day

The above chronic medication approval process is allowed for up to 3 months in all clinics and up to 6 months at Hamad Medical Center.

My policy restricts cover on pre-existing/chronic conditions, please explain the term?

Pre-existing condition is an illness, injury, condition, or symptom that originated prior to the insured coverage date (policy enrolment date). This restriction applies to all insured in line with policy wording whether a diagnosed condition is known or unknown to the insured prior to the policy enrolment date; however considered as medically pre-existing (present/manifested in the body prior to the commencement of insurance cover).

I am confused with “pre-authorization” or “prior approval”. Isn’t this time consuming?

Look at the prior approval process in this way:

- Not every treatment requires approval

- Most out-patient services do not require prior approval

- Prior approval is limited to hospital admission (as in-patient) and a few other outpatient services such as physiotherapy, MRI, etc. and is also linked to a certain cost schedule

- A medical provider may request prior approval if in doubt of the treatment under your insurance coverage

- In case you experience any delay, please be patient and contact us via our 24/7 helpline on +974 444 55 999

Our claims administrator replies to almost 97% of the requests within 20 minutes which helps in:

- Reducing your waiting time at the providers

- Giving you the necessary medical attention quicker

Does the same procedure apply in emergencies?

Your health is a priority. A medical condition that may lead to disability or loss of life will not wait for our approval. Please let us know a day or two after the admission. This helps us assist you much faster and reduces any future misunderstanding. Wherever you are in the world, Seib Insurance covers you for emergency treatment.

What is the general waiting time for a pre-approval?

The waiting time for an approval depends on the type of service requested. Generally speaking, the following timings apply:

- 2 – 5 minutes for automatic approvals. This is for consultations, medications and other straight forward treatment requests such as X-Rays, blood tests and eligible medicine dispensation

- 30 minute approvals for minor out-patient day care cases and/or surgeries

- 1 working day approval for in-patient cases

Documents provided by the clinic/hospital need to be complete in order for the above timings to be met. If the file was submitted incomplete, this could lead to a delay and a breach of the above timings. We urge all insureds to call our 24/7 helpline number should they feel they are experiencing a delay at any time in order for the team to accelerate the process.

What is Reasonable & Customary (R&C)?

Reasonable & Customary (or R&C) is the average price reimbursed for any eligible treatment in accordance with the healthcare network subscribed to by the policyholder. This is a benchmark used by all insurance companies as a reference of reimbursement on every service. In order to avoid deductions related to this clause, Seib Insurance encourages its insureds to seek treatment within its extensive providers' network, where cover will be at the maximum in accordance with the policy terms and conditions.

What is the basis of claims adjudication and how do I know whether my claim has been fairly adjudicated?

Seib Insurance follows an international protocol on claims reimbursement. When a case is within a grey area, we always adjudicate in favor of the insured to ensure maximum fairness. If the case is absolutely not covered and the insured is still left with a doubt, he/she may request for the basis of rejection (or short payment/deductions) and a Seib Insurance customer service representative will explain the reimbursement calculation to the insured by providing policy/clause references justifying the adjudication.

Why can’t Seib Insurance contact medical providers to retrieve documents required for claims processing? It is a hassle for me to return to a clinic/hospital after receiving a treatment?

All hospitals follow a procedure that is in line with data protection for their patients. This ‘Patient Confidentiality’ Clause is there to protect the patient in cases where the information is at risk from being shared without his/her consent. In following this rule, most (if not all) clinics, will release information related to medical records, including but not limited to test results and diagnosis, only to the patient him/herself. It is important to understand that this is to protect the patient's privacy within a legal framework followed within international medical norms.

Is there any exclusion under my insurance?

Yes, examples of common exclusions are mentioned within your schedule of benefits. Please refer to your insurance policy wording for all applicable exclusions.

What is the period of Insurance cover?

One year (365 days) from the date of policy issuance unless a different period of insurance was agreed with you specifically.

How can I file a complaint?

Should you have a complaint about deficiency in the services or the products offered, please contact our Compliance & AML Manager by phone on the following numbers: (+974) 4402 6807 or (+974) 4402 6888 or by mail to the following postal address: Seib Insurance and Reinsurance Company, P.O. Box 10973, Doha Qatar, or by email to complaints@seibinsurance.com, setting out clearly the exact details of your complaint.

We handle customer complaints fairly, efficiently and with due diligence as per the complaints procedure. If you remain dissatisfied with our response, you have the right to refer the complaint to the QFC Customer Dispute Resolution Scheme either by email to complaints@cdrs.org.qa or by post to “The Customer Dispute Resolution Scheme”, P.O. Box 22989, Doha Qatar.